The main body in charge of controlling and enabling the import and export of goods across the national boundaries is Sri Lanka Customs. Key elements of Sri Lanka’s foreign trade and border security, customs guarantees legal trade, income collecting, and prevention of illegal trafficking.

This guide walks you through everything you need to know about Sri Lanka customs, regardless of your business looking to register for trade, travel arriving in Colombo, or importation of goods.

What is Sri Lanka Customs?

Under the Ministry of Finance, Sri Lanka Customs is a state department assigned to handle foreign trade compliance, duty collecting, and nation economic protection. The department guarantees that, including taxes, limited goods control, and foreign exchange policies, all imports and exports follow the legal framework of the nation.

Considered among the oldest government departments in Sri Lanka, the institution has been running for more than 200 years. Although its headquarters is in Colombo, its activities cover all entrance ports— airports, seaports, bonded warehouses.

Contact Details

| Address | Sri Lanka Customs, No.40, Main Street, Colombo 11, Sri Lanka. |

| Customs Enquiry Point | 1915 (Toll Free) |

| Tele | +94 11 2143434 / +94 11 2221602-3 / +94 11 2221607 / +94 11 2221611 / +94 11 2221713 |

| Fax | +94 11 2446364 |

| dgc@customs.gov.lk | |

| Website | www.customs.gov.lk |

| www.facebook.com/SriLankaCustoms | |

| X | x.com/custom |

| YouTube | www.youtube.com |

| Important Links | |

| Customs Company Registration | ereg.customs.gov.lk/registrations |

| Customs Exchange Rate | customs.gov.lk/exchange-rate |

| ASYCUDA |

customs.gov.lk/about-us/directorates-and-divisions/ict-directorate |

| Vehicle Verification Portal | services.customs.gov.lk/vehicles |

| Tender Sales | customs.gov.lk/tender-sales |

| Additional Services | services.customs.gov.lk |

| News | customs.gov.lk/news-and-notices |

Core Duties and Responsibilities

Sri Lanka Customs performs a wide array of critical functions to keep the nation’s trade sector secure and efficient:

- Customs gathers import taxes, VAT, excise duty, and other levies on commodities.

- The department looks at shipments for contraband including drugs, fake goods, or banned chemicals.

- Customs enforces trade-related laws including intellectual property rights and product restrictions.

- Trade facilitation helps companies by means of digital systems and quick clearance.

- The department keeps thorough records of every trade transaction, which helps to guide policies.

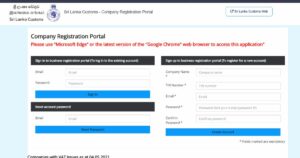

How to Register with Sri Lanka Customs

Should you be a company importing or exporting goods, you first have to register with Sri Lanka customs. This covers people, businesses, and clearing agents.

Step-by-Step Guide:

- Access the Customs Company Registration Portal. at https://ereg.customs.gov.lk/registrations.

- Fill out the registration form with required documentation (BR copy, TIN, NIC/passport, etc.).

- Await approval and complete your digital EDI (Electronic Data Interchange) profile.

- Once approved, you can begin submitting online declarations and tracking shipments.

Registration is mandatory for engaging in international trade through Sri Lanka’s formal ports.

Sri Lanka Customs Exchange Rate Explained

Customs converts foreign currency value of imported goods into Sri Lankan Rupees using a designated weekly exchange rate. Not the Central Bank rate, but this rate that Customs uses—published on their website.

For accurate tax and duty calculations:

- Visit: Sri Lanka Customs Exchange Rate

- Check updates every Monday.

- Always use the customs rate when estimating total landed cost for imports.

Understanding Import Tariffs

Under Sri Lankan law, all imported goods are liable to several taxes and levies. Tariffs are set depending on the HS code—Harmonized System code—of the good.

Types of Import Duties:

- Customs Duty: 0%–30%, depending on the product type.

- VAT: 15% on applicable goods.

- PAL (Port and Airport Levy): 5% or 7.5%.

- CESS: A variable levy applied to protect local industries.

- Excise Duty: Applied on specific goods like vehicles, alcohol, and tobacco.

Tip: Always use the online tariff lookup tool or consult a clearing agent to know your exact tax obligations before importing.

Sri Lanka Customs Auctions and Tender Sales

When goods remain unclaimed, are seized, or abandoned, Sri Lanka Customs disposes of them through public auctions or tender sales.

What You Should Know:

- Auctions are typically held at warehouses like Orugodawatta or airport cargo centers.

- Goods range from electronics and vehicles to household items and perishables.

- Participation is open to the public, and details are announced on the official website and newspapers.

- Winners must pay duties and taxes before clearing the items.

Small businesses and individual buyers have a great chance at these auctions to get worthwhile objects at reasonable rates.

How to Import a Vehicle to Sri Lanka: Regulations and Step-by-Step Guide

The import process for vehicles to Sri Lanka falls under the supervision of Sri Lanka customs together with the Ministry of Finance and the Department of Motor Traffic (DMT) which operates under established guidelines. Here is a complete guideline with necessary rules for importing vehicles into Sri Lanka.

1. Understand Eligibility & Restrictions

Before starting, ensure that:

- You are eligible to import a vehicle (individual, business, or permit holder).

- The vehicle type is permitted for import (cars, motorcycles, vans, etc.).

- The vehicle meets age and emission regulations.

Common Restrictions:

- Brand-new vehicles must be Euro IV compliant (or above).

- Used vehicles are restricted by age limits (typically not older than 2 years for most vehicle types).

- Diesel vehicle imports are tightly regulated or prohibited.

- Left-hand drive vehicles are not allowed unless for specific purposes (e.g., heavy machinery).

2. Determine Vehicle Type and Import Tax

Sri Lanka imposes very high taxes on vehicle imports. Taxes depend on:

- Vehicle type (car, motorcycle, hybrid, electric, etc.)

- Engine capacity (CC)

- CIF (Cost, Insurance, Freight) value

- Fuel type (Petrol/Diesel/Electric/Hybrid)

Major Taxes Include:

- Customs Duty

- Excise Duty

- VAT (15%)

- PAL (Port and Airport Levy)

- CESS (if applicable)

3. Secure an Import Permit (if applicable)

Some vehicle imports require a special import permit, especially:

- For government officials or returnees under permit schemes

- For electric or hybrid vehicles

- For vehicles above a certain value or type

Apply through the Ministry of Finance or relevant agency if a permit is needed.

4. Choose and Purchase the Vehicle

Once eligibility is confirmed:

- Choose a reliable exporter.

- Make the purchase with proper documentation: invoice, bill of lading, insurance certificate, and inspection certificates.

Ensure the vehicle is shipped with:

- Original invoice

- Export certificate or registration document

- Packing list and shipping documents

- Emission and roadworthiness certificate

5. Arrange for Shipping

Most vehicles are shipped via Roll-on/Roll-off (RoRo) or containerized shipping. Choose a shipping line with services to Colombo Port.

Track the shipping status and request the Bill of Lading from the exporter.

6. Appoint a Licensed Clearing Agent

Appoint a licensed customs clearing agent in Sri Lanka to handle:

- Customs declarations via ASYCUDA World system

- Duty and tax calculations

- Document submissions

- Vehicle clearance at Colombo Port

You must provide your clearing agent with a Power of Attorney and original documents.

7. Submit Customs Declaration

Your agent will file a CUSDEC (Customs Declaration) electronically, attaching:

- Invoice

- Shipping documents

- Proof of payment

- Import permit (if applicable)

The vehicle will be examined by Customs and a tax assessment will be issued.

8. Pay Import Duties and Clear the Vehicle

Once the duty assessment is complete:

- Pay all applicable taxes (through bank or online payment system).

- Submit receipt to Customs.

- Get clearance from Sri Lanka Ports Authority.

Upon final clearance, the vehicle is released from port custody.

9. Register the Vehicle with the Department of Motor Traffic (DMT)

Registration Requirements:

- Customs clearance documents

- Original Bill of Lading

- Emission test certificate

- Roadworthiness certificate (for used vehicles)

- Engine and chassis number photos

- Proof of address and NIC

Register the vehicle at DMT – Werahera or Colombo to receive your number plate and registration certificate.

10. Obtain Insurance and Road Tax

Before driving on the road, ensure:

- You purchase mandatory third-party insurance (or comprehensive).

- You pay annual revenue license fees.

You’re now legally allowed to drive your imported vehicle in Sri Lanka.

Final Notes and Recommendations

- Stay updated on import bans or restrictions. The government sometimes suspends vehicle imports for economic or policy reasons.

- Consult a customs expert to avoid missteps, especially with duty calculations and documentation.

- Avoid black-market agents or unofficial dealers.

Online Services and Digital Access

Sri Lanka Customs offers a range of digital services to make trade, tracking, and compliance easier.

Key Online Services:

- ASYCUDA World: The digital system for lodging import/export declarations.

- Exchange Rate Listings: Updated weekly.

- Online Payment System: Pay duties, taxes, and penalties online.

- Cargo Tracking: Real-time tracking of goods via e-manifest.

- Company & Agent Registration

- e-Forms and Clearance Notices

- Tender and Auction Notices

All services can be accessed through eservices.customs.gov.lk

ICT Directorate: Driving Customs Digitization

The ICT Directorate of Sri Lanka Customs is responsible for managing the department’s technology platforms. It ensures:

- Continuous updates of ASYCUDA systems.

- Network and data security.

- Helpdesk support for digital services.

- Integration with port authorities and other government platforms.

Reducing delays, boosting openness, and modernizing trade facilitation in Sri Lanka have all been greatly aided by the ICT unit.

How Much USD Can I Bring into Sri Lanka?

Travelers are permitted to bring foreign money—including US dollars—but only within specific limits.

- You could have up to USD 15,000 without declaring it.

- You have to declare more than USD 15,000 at customs upon arrival.

- You also have to declare any intention to retain more than USD 10,000 in cash.

Remember to retain your declaration slip for future currency exchanges or re-exporting cash.

What Items Can I Bring to Sri Lanka?

Travelers entering Sri Lanka are free to bring a limited quantity of items duty-free. One should be aware of what is forbidden, limited, or allowed.

Duty-Free Allowances:

- Personal clothing and effects.

- 2 bottles of wine and 1.5 liters of spirits.

- Gifts valued up to USD 250.

- Cameras, laptops, and other personal electronics (1 item each).

Restricted Items (Need Permission):

- Medicines

- Live animals or plants

- Gold in excess of permitted amount

- Drones and communication equipment

Prohibited Items:

- Narcotics and illicit drugs

- Pornographic material

- Counterfeit currency or goods

- Firearms and explosives

Always declare valuables and consult the Customs guide if in doubt.

How to Exchange Money in Sri Lanka

It’s recommended to use licensed money changers or banks for currency exchange.

Where to Exchange:

- Banks at Bandaranaike International Airport (open 24/7).

- Authorized exchange booths in cities.

- Hotel counters (less favorable rates).

Avoid black-market exchanges, as it is illegal and may lead to legal penalties. Retain exchange receipts, especially if you plan to reconvert currency when leaving the country.

Final Thoughts

Whether your business is small, you travel, or you trade, Sri Lanka Customs offers a clear, progressively digital platform to enable effective regulation navigation and goods movement. Understanding customs helps you save time, money, and stress from online registration to auction participation.